The Future Beyond FinTech

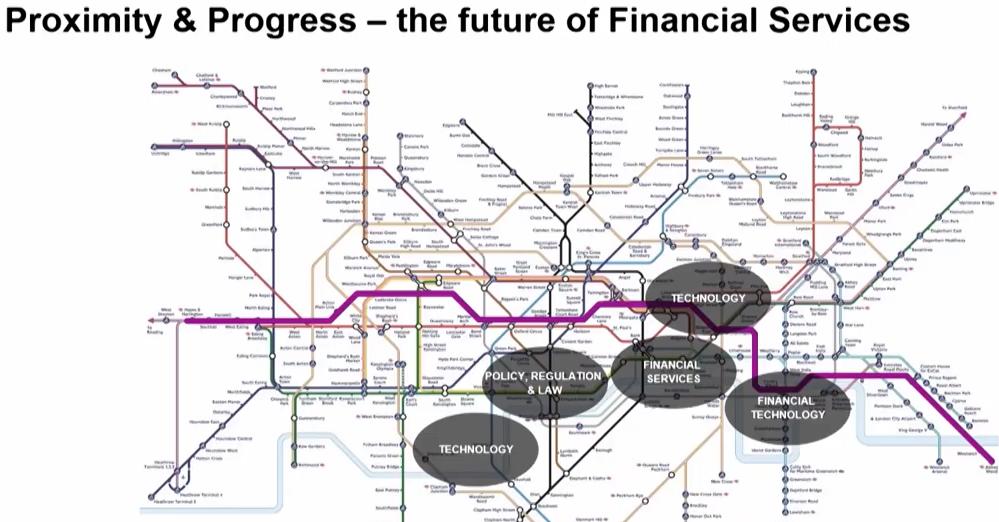

UK’s Fintech sector has emerged as the global leading FinTech hub in the world now and years to come due to the UK government acknowledges the positive impact of FinTech on financial services, as well as regulators that support innovation to better meet the consumers and business needs. London alone has over 40,000 financial services companies and covers 37% of Europe’s financial services industry. With its geographical advantages as a global FinTech hub, London recently added Cross Rail as shown in the tube map below to bring Financial Services area, Policy Regulatory & Law area, Financial Technology area, and Technology area together, so that it’s possible to export FinTech products/services in a day in London. The UK strives for the goal is to continue to be recognized as the world’s best place to start and grow a FinTech firm.

Furthermore, Financial Conduct Authority (FCA) is “a financial regulatory body in the United Kingdom formed in 2013 to regulate financial services firms (both retail and wholesale) in providing services to consumers and maintaining the integrity of the financial markets in the UK. Today FCA is the conduct regulator for 59,000 financial services firms and financial markets in the UK, and the prudential regulator for over 18,000 of those firms.” (cited from https://www.fca.org.uk/about/the-fca). FCA is mandated to provide prudential protection to protect the consumer, as well as regulate the banks by creating more competition to drive competitions. In order to facilitate data sharing in UK banking, the UK has established new data standard, API standard and security standard, in addition to increase innovation and competition to create greater values and services.

Due to sharing of sensitive personal data, the controllers of personal data must generate appropriate technical and organizational measures to protect personal data. The Information Commissioner’s Office (ICO) is an independent regulatory office dealing with the Data Protection Act 2018 and the General Data Protection Regulation (GDPR) and etc. Data Protection Act 2018 is “a United Kingdom Act of Parliament which updates data protection laws in the UK. The Act introduces new offences that include knowingly or recklessly obtaining or disclosing personal data without the consent of the data controller, procuring such disclosure, or retaining the data obtained without consent. Selling, or offering to sell, personal data knowingly or recklessly obtained or disclosed would also be an offence. However, Data Protection Act 2018 is not limited to the UK GDPR provisions as it applies the EU's GDPR standards.” (cited from https://en.wikipedia.org/wiki/Data_Protection_Act_2018). Moreover, General Data Protection Regulation (GDPR) is “a regulation in EU law on data protection and privacy for all individual citizens of the European Union (EU) and the European Economic Area (EEA). GDPR also addresses the transfer of personal data outside the EU and EEA areas. The GDPR aims primarily to give control to individuals over their personal data and to simplify the regulatory environment for international business by unifying the regulation within the EU..” (cited from https://en.wikipedia.org/wiki/General_Data_Protection_Regulation)

As Alastair Lukies shared in Fintech Taipei International Fintech Forum (2019/11/29) “We should change our mindset and not seeing technology as an industry in its own rather technology companies are all pervasive horizontally across every industry. Fusion industries is the future of our economy globally, when you think of financial services, you think of FinTech; you think energy you think energy tech; you think medical you think med tech.” Hence, financial services, technology companies and regulators must work together to share this new B2B2C ecosystem economics, trust would be the marketable asset for banks, and collaboration would be the key navigating the path to the new payments in this new ecosystem.

Note: Alastair Lukies is FinTech Alliance and UK Prime Minister’s Business Ambassador for FinTech (2014-2019)