TPIsoftware | API Management Platform | Open Banking

Open banking originated in 2015 under The Revised Payment Services

Direcctive of the EU. In August of the following year (2016), Britain

first asked its 9 major banks to adopt the system, then in 2018 they

introduced it forcefully. Afterwards other countries such as USA,

Australia, and Singapore joined in creating related laws, encouraging

the initiation of Open Banking in banks. This new campaign is also

coming from Europe to Taiwan. In 2019, the Taiwan Financial

Supervisory Commission finalized the introduction of Open Banking in

Taiwan into three stages.

3 Phases of Open Banking in Taiwan

2019

Phase I

Public information

Open product information, like: exchange rates, mortgage

interest, etc.

2020

Phase II

Personal information

Personal banking accounts and checking balances can be

consolidated through a third party APP.

2021 Q1

Phase III

All information

Payment, transaction, and transfers, etc, can be done through a

third party product.

3 Phases of Open Banking in Taiwan

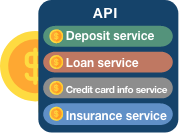

digiRunner API managing platforms reflect the law requirements of open

banking financial supervisory commission, by unifying stands and

safety managing mechanism and accelerating extensive cooperation

between financial industries and TSP industries, to achieve industrial

reach and expland profit.

Traditional Banking VS Open Banking

Traditional banking Service reach centralized, little versatility, and higher user

service conversion costs.

Consumer

Bank

Finance service

Traditional Banking VS Open Banking

Open banking In alliance with multiple industries, high versatitlity with

service development, keeps the customer's needs closer.

Consumer

TSP

Finance service

Bank

Open information for each steps

Open information for each steps are included down below

Step one-Publish open information

information consolidation

incease efficiency

incease efficiency

digiRunner; API managing platforms have patented service that

doesn't inhibit special features of hot deployment. Up to 50

percent of development speeds between platforms and th

adjoining efficiency between downstream systems are increased.

API's auto explore, immediate warning, transaction managing

features can accomplish the safety management in transport

layer, information layer, and behavior layer, allowing IT

personnel not have to worry about the cyber security of the

mainframe platform, and can directly authorize different

systems directly from the platform, taking out the extra step

to fix programming like in the past and greatly decreases

management and maintenance time.

1

Step two-Publish personal information

authorization mechanism

Covering of everything

Covering of everything

Comply with Open Banking API standards, personal information

and transaction sensitive information are completely

protected. From date transport layer (confidentiality, data

integrity, source of information, unrepeatability),

information layer (information completeness verification,

encrytion on sensitive personal information, anti-hacking),

behavior layer (OAuth2 verification mechanism and

authorization timeliness, Client authorization and IP Check)

all are protected from risks of cyber security to assist in

provided Token mechanism, to efficiently manage API users

which includes authorization mode and flow managment.

2

Step three-Publish transaction information

finance data

safe sharing

safe sharing

Through all-round digiRunner API, managing platform structures

realize open banking's final purpose, under the users

agreement, TSP affiliates can connect account payment,

deduction, transaction through APP after integrating account

infroamtion to really achieve "Finance date safe sharing,"

providing consumers a more complete fianancial experience.

3

digiRunner's professional consultant team, assists in creating the

skill structure that conforms with each countries Open Banking

standards.

Client

TSP affiliates

Bank

Bank or external examination

Non-encrypted HTTP

Encrypted HTTPS

Agent

Agent1 Users initiate banking services

TSP verifies users

2 Process demonstration

Figure A

3 Return authorization form bank

Sends Authorization Code to TSP

7.3 Results returned

Return used API resource

TSP Server

Third party dealer

Third party dealer

4 Demand saved authorization

Sends Authorization Code to bank portal

6 Authorization returned

Resends access_token

*Picks JWE token

7.1 Demand access of information

Uses Access_token

Make use of API resources

Make use of API resources

OAuth Server

(Bank or APIM)

(Bank or APIM)

Resource

Server

APIM

Server

APIM

5 External examination

Calls API external examination

7.2 Accessed resources

Access services provides by bank

Identity Sever

(Supports third party or bank verification Sever)

(Supports third party or bank verification Sever)

Backstage system bank services

Figure A

Communicates through TSP app and Oauth server

User login

Login online bank

1. Core screen pops out (outer URL)

2. User enters ID/PWD

2. User enters ID/PWD

Level/service selection

Open features based on level

3. Verfication successful, obtains TSP Server (Client); can

now use Group List

4. Jumps to page providing User the option to provide agreement authorization

4. Jumps to page providing User the option to provide agreement authorization

Enter verification code

Bank returns authorization permit

5.Obtain Authorization Code

When users authorize for TSP to process related bank information,

no records of account username and password would be left behind

or saved, rather only through user authorzation will related

information be integrated.

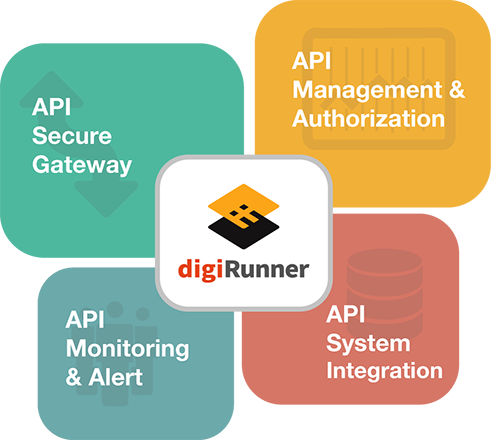

When selecting a API managing platform, it not only raises the

efficiency of enjoining APIs, it also greatly decreased internal

personel's time in managing API. It's a indispensible helper in a time

where both sides sare entering Open Banking. On the current market,

API managing platforms all provide unification of interface formats

and information encrypting features. Besides that, if platforms still

provide graphical user interface, allowing anyone to learn how to

operate immediately, it can save time in internal system

familiraizaion and managment, also whether platforms can provide

external cooperating partners the authorization to managing features,

is also a hot top of consideration; in parts of identity verifaction

and API authorization, what every coutry now reference is from Oauth2

standards to strenghten managment, therefore by selecting something

that satisfies all ID verifcation methods and authorization standards

of platforms can help financial setups and TSP save more time in

developing related API.

Strengthen information security protections

ID verification that complies with Oauth2 standards and API

authorization mechanism, interface format unification, information

encryaption.

1

Elasticity increases service

Adjusting elasticity based on needs and expaning API application

provies banking and financial industries more flexibility in using

financial information and publishing API.

2

Keeping the users close

Graphical interfaces that are user friendly provides complete API

managing analysis report.

3

Service security stable

Platforms have flow rate controls, cancelation of repeating

transaction such unique mechanisms, to nsure service security

stability is uninterupted.

4

Rich experienced examples

Native Taiwan manufacturers, riding on multiple years of service

experiences, collecting industrial, law and science opinions,

providing a complete API managing consulting experience.

5

Test