The Market is Changing Fast

How Can Insurance Providers Keep Up with It?

Same as FinTech, InsurTech is disrupting the insurance market with a growing need for digital technology. As customer nowadays are expecting faster underwriting reviews, how can insurers, insurance brokers and agents respond to the new wave? Besides developing InsurTech on their own, what else can they do to innovate their services and expand the customer base?

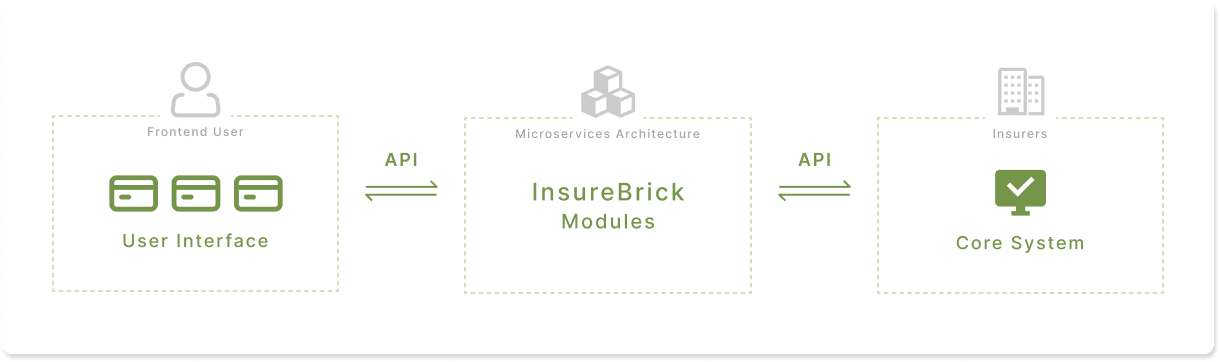

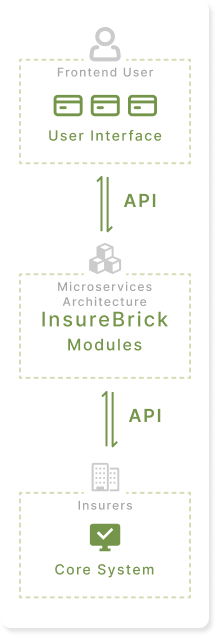

InsureBrick: Innovative Microservice Middleware

Stay on Top of Trends

Stay on Top of TrendsCentralized Business Logic for Optimal Efficiency

Centralized insurance rules to reduce redundant workload

Agile & Adaptive

Agile & Adaptive28 Flexible Modules

Available for single implementation and integration

Responsive & Flexible

Responsive & FlexibleAPI Compliance

Enabling innovative services with flexible combination

Scalable & Innovative

Scalable & InnovativeMicroservice Architecture

A lightweight and multi-functional cloud modular middleware

Application Framework

Personalized Insurance Platform

Leading the Way

Enhanced adaptability in a changing business environment and optimized service efficiency

Efficiency Optimization

New product launch time reduced by 90% to stay ahead of your competition

Exceptional Experience

User-friendly interface for easy data accessibility

Web-only Insurers

E-insurance Middleware

Property Insurance Middleware

Life Insurance Middleware

Broker & Agent Platform

Success Stories

E-insurance Platform

InsureBrick assists internet-only banks in deploying e-insurance platform with microservices architecture, which allows quick connection with core systems. The modularization further enables scalability and flexible integration, facilitating the product launch and business expansion.

Automobile Insurance Platform

Assisted Cathay Century Insurance in building an interactive online auto insurance platform using data analytics with personalized recommendation to provide fragmentation services and increase customer adhesion.

Mobile Insurance Web & App

Assisted Fubon Life Insurance in building mobile insurance web and app with 4 exclusive system modules, verification mechanism and 3rd-party payments, providing fast and optimized insurance experience.